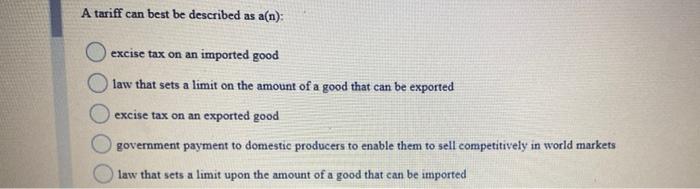

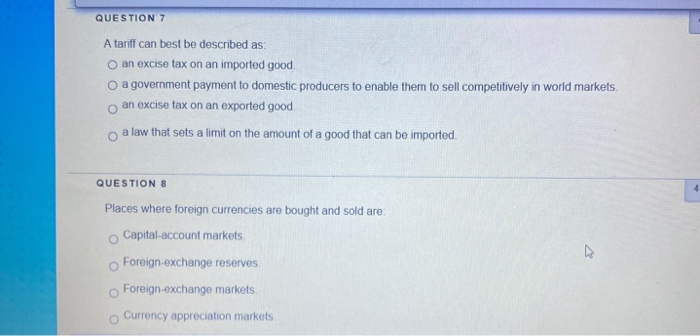

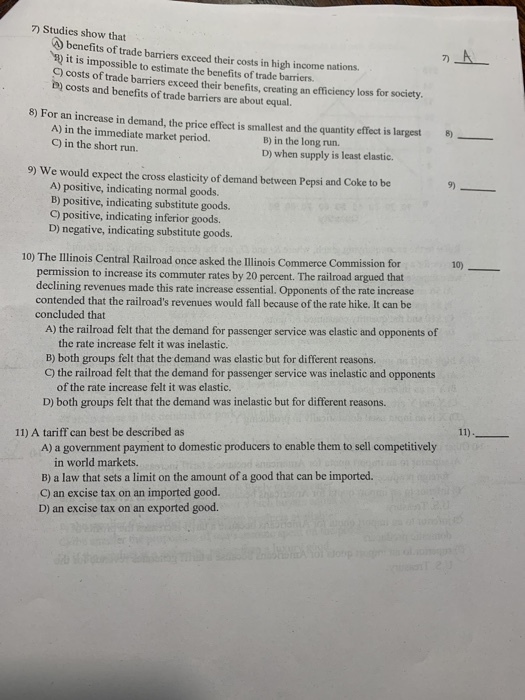

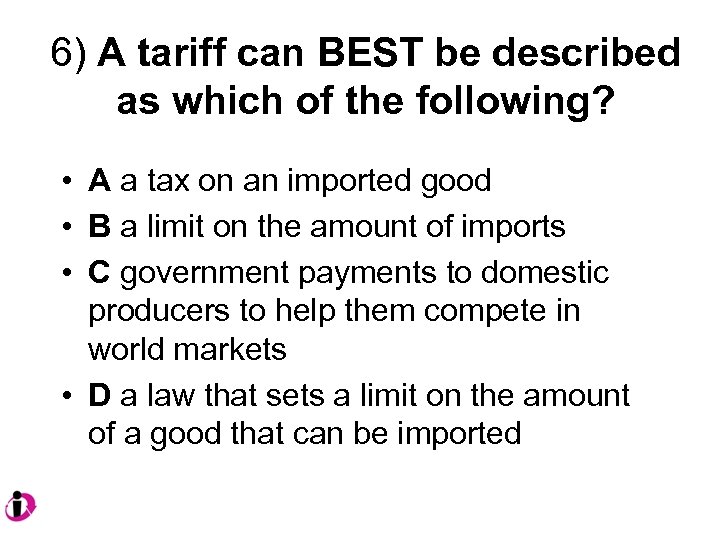

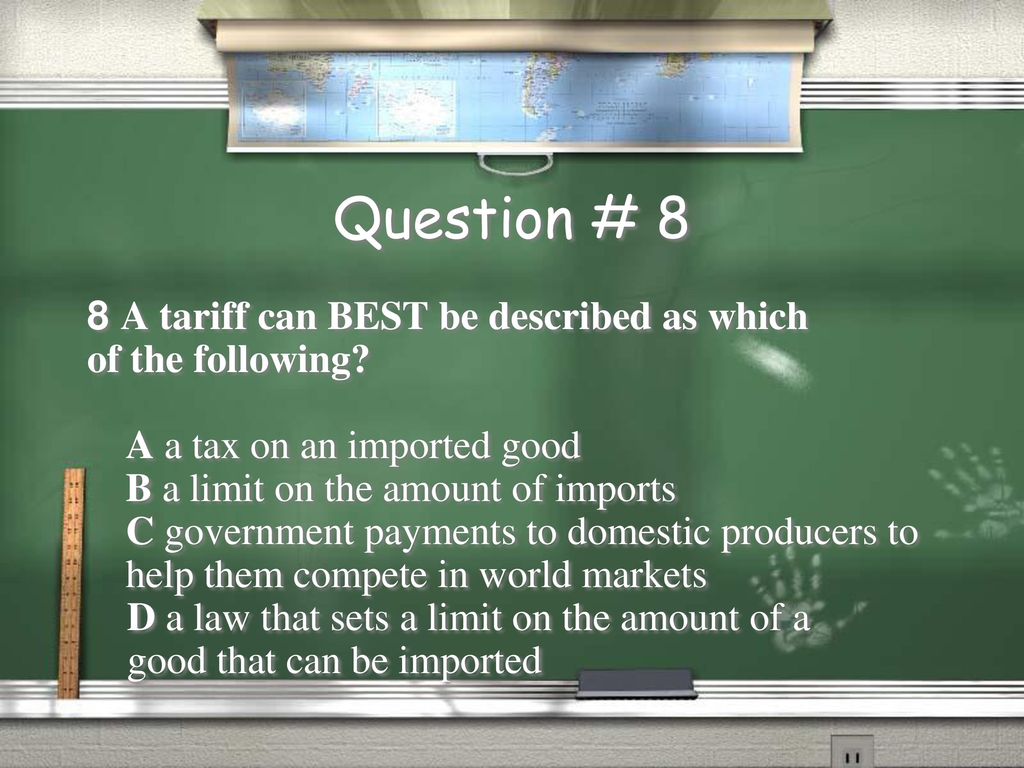

A Tariff Can Best Be Described As

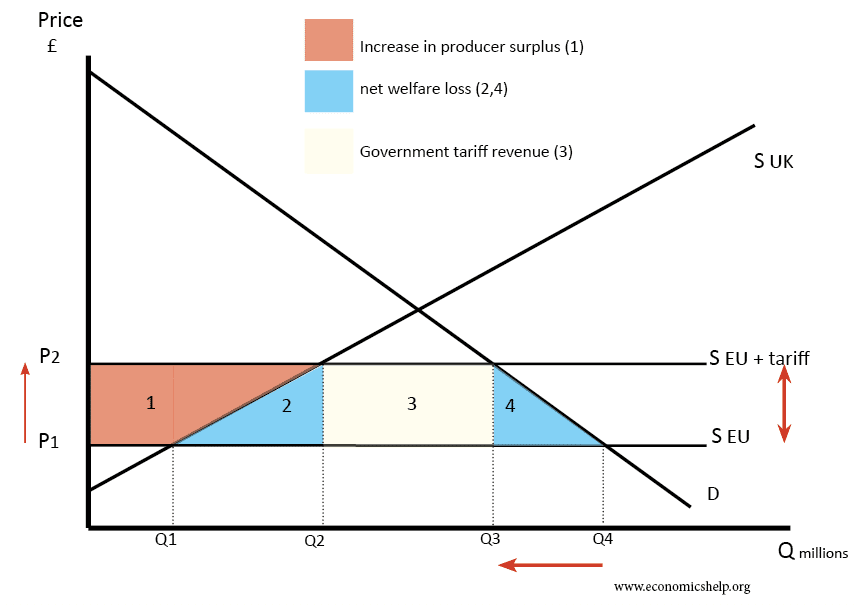

A tariff can best be described as. In 1922 Congress had enacted the Fordney-McCumber Act which was among the most punitive protectionist tariffs passed in the countrys history raising the average import tax to some 40 percentThe Fordney-McCumber tariff prompted retaliation from European governments but did little to dampen US. The aim of tariffs are to either raise the prices of imported products to at least the level of current domestic prices or increase revenue for the government. Put simply a tariff is a specific tax levied on an imported good at the border.

According to the World Trade Organization WTO. A tariff can best be described as. Ambulatory care can be described as a mindset a working assumption is made that the patient will not need a bed.

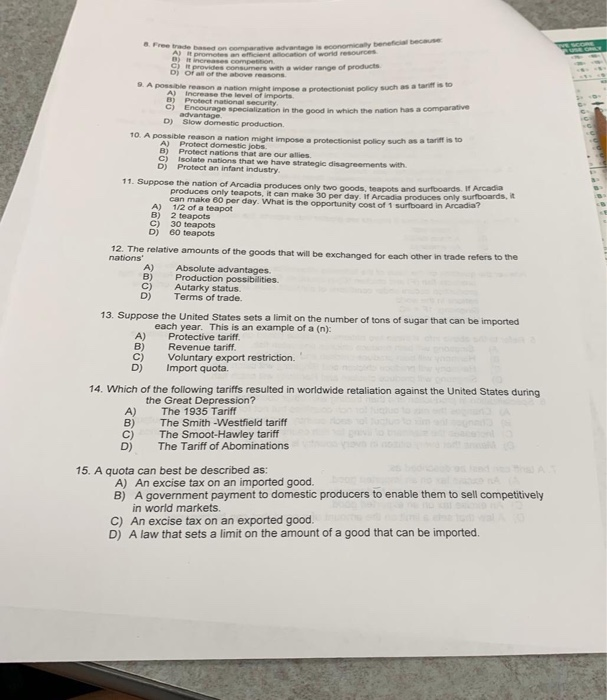

A law that sets a limit on the amount of a good that can be imported. A tariff is a duty or tax imposed by the government of a country upon the traded commodity as it crosses the national boundaries. The Smoot-Hawley Act is the Tariff Act of 1930.

This preview shows page 12 - 15 out of 27 pages. A tariff can best be described as a an excise tax on. An excise tax on an imported good.

An excise tax on an exported good. The tariff or duties imposed upon the goods originating in the home country and scheduled for abroad are called as the export duties. A tariff can best be described as.

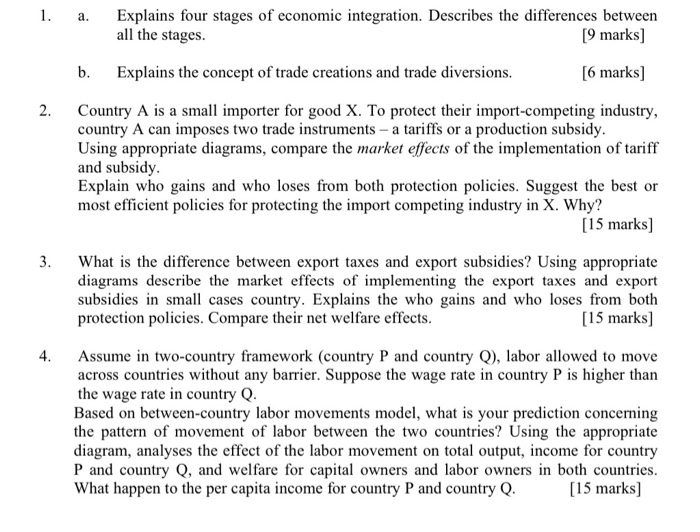

9A tariff can best be described as. A government payment to domestic producers to enable them to sell competitively in world markers. B either a tax on or a limit on the quantity of an imported good.

A limit on the amount of imports C. Tariffs are taxes or duties that are levied on imported goods.

A tariff can best be described as A.

Jan 17 2021 Uncategorized Uncategorized. An excise tax on an imported good B. A law that sets a limited upon the amount of a good that can be imported. A law which sets a limit on the amount of a good which can be imported. A government payment to domestic producers to enable them to sell competitively in world markets. Put simply a tariff is a specific tax levied on an imported good at the border. A government payment to domestic producers to enable them to sell competitively in world markets. A law that sets a limit on the amount of a good that can be imported. A tariff can BEST be described as which of the following.

A law that sets a limit on the amount of a good that can be imported. An excise tax on an imported good. The Smoot-Hawley Act is the Tariff Act of 1930. Transcribed Image Text Question 4 1 pts A tariff can best be described as. A either a tax on or a limit on the quantity of an imported good. An excise tax on an imported good B. A tariff can best be described as A.

/trade-wars-definition-how-it-affects-you-4159973_color-bf45e3ae6bad40e09e5485c8f6fa7c75.png)

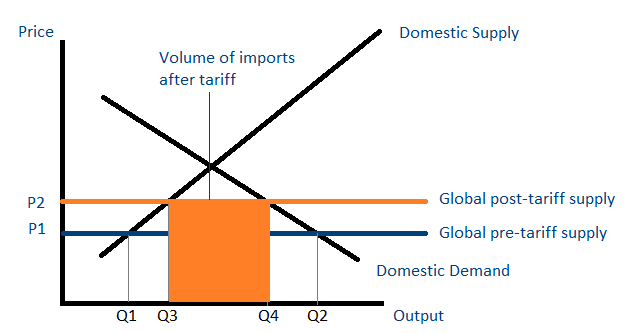

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

Post a Comment for "A Tariff Can Best Be Described As"